Others

Nifty VIX (India Volatility Index)

The India Volatility Index in short is termed India VIX. It indicates the degree of volatility or fluctuation traders expect over the next 30 days in the Nifty50 Index

- Historical Volatility

- Forecasted Volatility

- Implied Volatility

- Avoid buying options when VIX is high

- Avoid selling options when VIX is low

ET Money Answers Your Questions on Mutual Funds | ET Money

Geopolitical Risk Indicator - World - Global Geopolitical Risk Index | MacroMicro

Equity Risk Premium

- An equity risk premium is an excess return earned by an investor when they invest in the stock market over a risk-free rate

- This return compensates investors for taking on the higher risk of equity investing

- Determining an equity risk premium is theoretical because there's no way to tell how well equities or the equity market will perform in the future

- Calculating an equity risk premium requires using historical rates of return

https://www.investopedia.com/terms/e/equityriskpremium.asp

The Price of Risk: With Equity Risk Premiums, Caveat Emptor! - YouTube

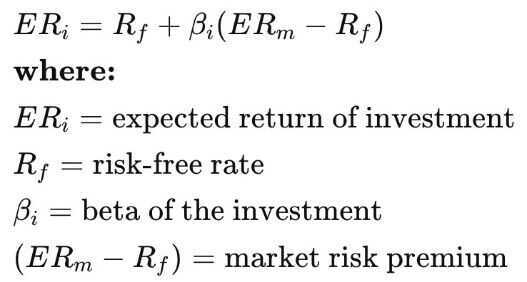

Capital Asset Pricing Model (CAPM)

The Capital Asset Pricing Model (CAPM) describes the relationship between systematic risk and expected return for assets, particularly stocks.CAPM is widely used throughout finance for pricing risky securities and generating expected returns for assets given the risk of those assets and cost of capital.

https://www.investopedia.com/terms/c/capm.asp

Zerodha Alerts

Long-Term ASM Stage 1 - Additional Surveillance Measures

Long-Term ASM Stage 1 is the first stage of Additional Surveillance Measures, a regulatory tool used to monitor stocks exhibiting consistent abnormal price or volume movements over a longer period. Key features include a mandatory 100% margin for all transactions and a daily price band of 5% or less to limit volatility.