Finance Terms

Asset Classes

-

Fixed income instruments

- Fixed deposits offered by banks

- Bonds issued by the Government of India

- Bonds issued by Government related agencies such as HUDCO, NHAI, etc

- Bonds issued by corporate's

-

Equity

-

Real estate

-

Commodities (precious metals)

Chartered Financial Analyst (CFA)

The Chartered Financial Analyst (CFA) program is a postgraduateprofessional certification offered internationally by the American-based CFA Institute(formerly the Association for Investment Management and Research, or AIMR) to investment and financial professionals.

It has the academic standing of a masters degree in the European Union and United Kingdom(Level 7 by NARIC), with level 2 being equivalent to a bachelors degree(Level 6 NARIC).The charter has highest level of global legal, regulatory, and academic recognition of finance-related qualifications, exempting CFA charterholders from various industry regulatory and/or academic requirements depending on the country (see CFA Regulatory Recognition).

The program teaches a wide range of subjects relating to advanced investment analysis, including security analysis, statistics, probability theory, fixed income, derivatives, economics, financial analysis, corporate finance, alternative investments, portfolio management, and provides a generalist knowledge of other areas of finance. A candidate who successfully completes the program and meets other professional requirements is awarded the "CFA charter" and becomes a "CFA charterholder". As of April 2021, at least 170,000 people are charterholders globally, growing 7% annually since 2012.Successful candidates take an average of four years to earn their CFA charter.

https://en.wikipedia.org/wiki/Chartered_Financial_Analyst

Accrual

Accrual (accumulation) of something is, in finance, the adding together of interest or different investments over a period of time. It holds specific meanings in accounting, where it can refer to accounts on a balance sheet that represent liabilities and non-cash-based assets used in accrual-based accounting. These types of accounts include, among others, accounts payable, accounts receivable, goodwill, deferred taxliability and future interest expense

- Accrued revenue: revenue is recognized before cash is received.

- Accrued expense: expense is recognized before cash is paid out.

TAM (Total Addressable or Accessible Market)

Amortization

-

the action or process of gradually writing off the initial cost of an asset.

Ex - due to the amortization of initial costs, the risks of negative working capital are mitigated

-

the action or process of reducing or paying off a debt with regular payments

Ex - because of amortization, you'll own your home by the end of the loan term

-

a period in which a debt is reduced or paid off by regular payments

75% of the mortgages have an amortization of 25 years or less

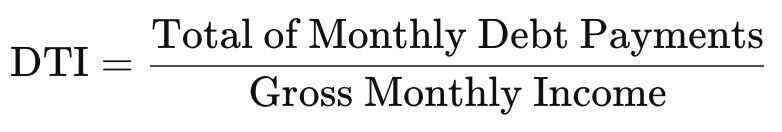

Debt Burden Ratio (DBR) / Debt to Income Ratio (DTI)

The debt-to-income (DTI) ratio is a personal finance measure that compares an individual's monthly debt payment to his or her monthly gross income. Your gross income is your pay before taxes and other deductions are taken out. The debt-to-income ratio is the percentage of your gross monthly income that goes to paying your monthly debt payments.

- The debt-to-income (DTI) ratio measures the amount of income a person or organization generates in order to service a debt.

- A DTI of 43% is typically the highest ratio a borrower can have and still get qualified for a mortgage, but lenders generally seek ratios of no more than 36%.

- A low DTI ratio indicates sufficient income relative to debt servicing, and makes a borrower more attractive.

https://www.investopedia.com/terms/d/dti.asp

Variable cost positive

Fixed cost positive

Contribution-margin-positive

Free cash flow positive

PAT - Profit After Tax

PBT - Profit Before Tax

ARR - Annual Recurring Revenue

ARR is a subscription-based company's yearly revenue from a subscription

NIM - Net Interest Margin

Net interest margin or NIM denotes the difference between the interest income earned and the interest paid by a bank or financial institution relative to its interest-earning assets like cash. Thanks to its frequent usage, it's become a part of the banking and financial lexicon.

Net interest margin = (Investment returns -- interest expenses) / average earning on assets

https://economictimes.indiatimes.com/definition/NIM

https://www.investopedia.com/terms/n/netinterestmargin.asp

ROCE (Return on Capital Employed)

- Return on capital employed (ROCE) is a financial ratio that measures a company's profitability in terms of all of its capital.

- Return on capital employed is similar to return on invested capital (ROIC).

- Many companies may calculate the following key return ratios in their performance analysis: return on equity (ROE), return on assets (ROA), return on invested capital (ROIC), and return on capital employed.

https://www.investopedia.com/terms/r/roce.asp

EMI - Equated Monthly Installments

Money Markets

The moneymarket is a market section where 'cash' is borrowed for a short time -- 1 day to a few months. In most economies, the money market securities are considered 'equivalent' to cash.Investopedia has this definition:"The money market is part of the fixed-income market that specializes in short-term debt securities that mature in less than one year. Most money market investments often mature in three months or less. Because of their quick maturity dates, these are considered cash investments. Money market securities are issued by governments, financial institutions, and large corporations as promises to repay debts. They are considered extremely safe and conservative, especially during volatile times"

CBLO - Collaterized Borrowing and Lending Obligations

BFSI - Banking, Financial Services and Insurance

Corporate Earnings Announcement

This is perhaps one of the important events to which the stocks react. The listed companies (trading on stock exchange) are required to declare their earning numbers once in every quarter, also called the quarterly earnings numbers. During an earnings announcement, the corporate gives out details on various operational activities including:

- How much revenue the company has generated?

- How has the company managed its expense?

- How much money the company paid in terms of taxes and interest charges?

- What is the profitability during the quarter?

AUM

In finance, assets under management(AUM), sometimes calledfunds under management(FUM), measures the total market value of all the financial assets which a financial institution such as a mutual fund, venture capital firm, or broker manages on behalf of its clients and themselves.

https://en.wikipedia.org/wiki/Assets_under_management

CAS (Consolidated Account Statement)

Dollar Cost Averaging (DCA) / Rupee Cost Averaging / SIP

Dollar-cost averaging (DCA) is an investment strategy in which an investor divides up the total amount to be invested across periodic purchases of a target asset in an effort to reduce the impact of volatility on the overall purchase. The purchases occur regardless of the asset's price and at regular intervals.

- Dollar-cost averaging refers to the practice of systematically investing equal amounts, spaced out over regular intervals, regardless of price.

- The goal of dollar-cost averaging is to reduce the overall impact of volatility on the price of the target asset; as the price will likely vary each time one of the periodic investments is made, the investment is not as highly subject to volatility.

- Dollar-cost averaging aims to avoid making the mistake of making one lump-sum investment that is poorly timed with regard to asset pricing.

Fixed vs Floating Interest Rate

- A floating exchange rate is determined by the private market through supply and demand.

- A fixed, or pegged, rate is a rate the government (central bank) sets and maintains as the official exchange rate.

- The reasons to peg a currency are linked to stability. Especially in today's developing nations, a country may decide to peg its currency to create a stable atmosphere for foreign investment.

Floating Rate vs. Fixed Rate: What's the Difference?

Others

- Non-Intitutional Buyers (NII)

- Qualified Institutional Buyers (QIB)

- Foreign Institutional Buyers (FII)

- Grey Market Premium (GMP)

- Non-oil, non-gold imports / exports (NONG imports / exports)

- ACORD Data Standards - ACORD - Wikipedia

- Disposition - the natural qualities of a person’s character, a usual way of behaving

- subordination agreement - A subordination agreement is a legal document that establishes the priority of debts owed to a borrower. It's also known as a priority agreement.

- Hypothecation - Hypothecation refers to pledging an asset as collateral for a loan without transferring ownership, allowing the borrower to retain possession and use the asset while the loan is outstanding.

- Indemnity Letter - An indemnity letter, or Letter of Indemnity (LOI), is a legal document that protects one or more parties from financial loss or liability if a contractual obligation is not met. It serves as an assurance that the indemnifying party will compensate the other for damages resulting from a specific failure to perform, and it is often drafted by a third party, such as a bank or insurance company, which acts as a financial guarantor. These letters are frequently used in shipping, banking, and general business contracts to provide confidence and allow for transactions to proceed.

Questions

https://www.toptal.com/finance/finance-managers/interview-questions

https://www.toptal.com/finance/financial-controllers/interview-questions

https://www.toptal.com/finance/finance-directors/interview-questions

Glossary of Financial Management Terms | Springer Publishing