Questions to company

Always don't say yes to any offer at that time, always sleep over it

Interview - Keep in mind

- Ask Good Questions

- Don't use buzzwords if you don't have a knowledge about them

- Clear and organized thinking

- Drive Discussions (80-20 rule, You must talk 80% of the time and interviewer 20%)

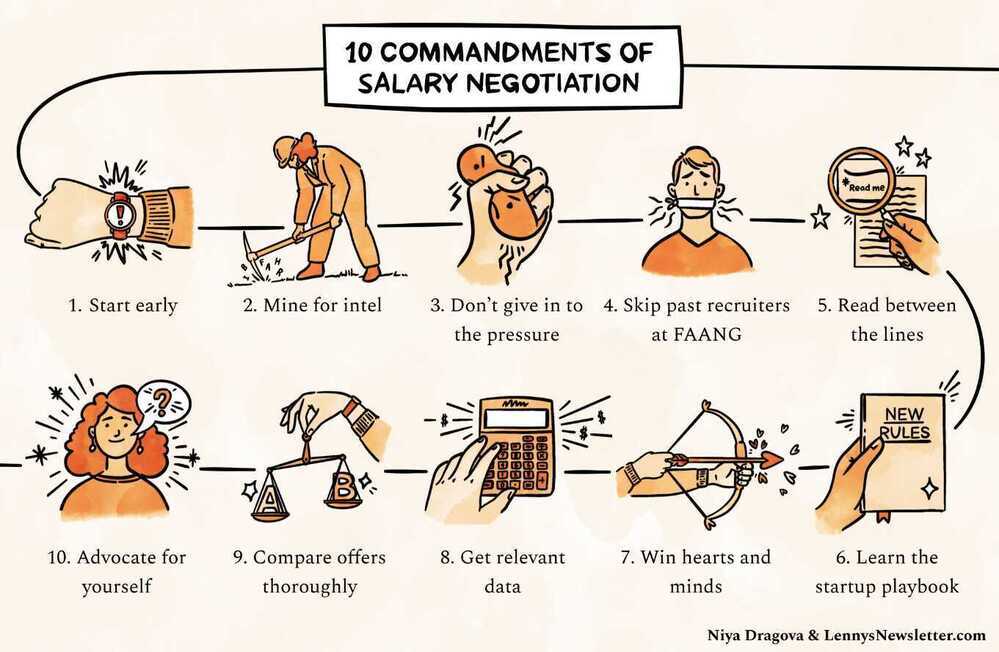

https://www.lennysnewsletter.com/p/negotiating-comp

https://auren.substack.com/p/lets-talk-about-founder-compensation

What is your current day-to-day like in last company?

- Mentoring and helping other developers

- Taking interviews

- Architecture meetings for next products

- Business meetings for driving value from products

- Discussing about how to improve current solutions using new technologies (graphql, kubernetes, terraform)

What is the most difficult project/thing that you have done?

- Getting the domain knowledge of the project I have been working on

Metrics that I follow

- Happiness (solving real world problems)

- Compensation

- Learning

Productivity

Questions

- What are your biggest weaknesses?

- What are your biggest strengths?

- Where do you see yourself in five years?

- Out of all the candidates, why should we hire you?

- How did you learn about the opening?

- What will be my roles and responsibilities as Solution Architect?

- Always find the person who you will be working under, because you will learn from that person only. - Why - Engineering productivity is key to building good software. It comes down to the manager to make sure the developer team is performing as expected.

- Find how can you grow in the company. (Both professionally and academically)

- Teaching must be a part of the company. (Best way to learn is to teach)

- More higher positions (Experience needed or knowledge needed)

- If you can go back 5 years ago and change one thing what would it be

Finance Questions from Company��

- Yearly bonus or Stocks

- EPF Contributions

- Medical benefits

- Life Insurance

- Term Insurance

- Renumeration for devices/hardwares

- Travel grants for Conferences

- Cloud access for ML/AI

- Relocation reimbursements

- Joining bonus

- Equity - Preference stack when getting an equity package

- Compensatory leaves (since I like to work on weekends)

- Study Leaves / Training / Certifications / Reimbursements

- Gratuity (The sum of money paid by an employer to an employee for his/her rendered services to the organisation for the tenure of his/her services)

- Work from home (WFH)

https://neilpatel.com/training/growth-hacking-unlocked/raise-money

Job Questions

- Notice period - Max 2 months (with buyout policy)

- Internal Switching Policy for long term

- Probation Period (3 months to analyze the company) - What if I didn't like the culture or anything else. I want to be in company for a long haul so I will first analyze the company.

- Working hours (flexible timings)

- Laptop (System)

- What is the current and average attrition rate of the company?

Legal Questions

- Indemnification

- non-compete

Other Question to company (Culture)

- Is this a new position being created or a existing position being filled

- Meet people in the company who are their for long term

- How do you ensure that people ideas are heard

- How do you access performance of individuals

- How do you tackle failure (one fails to deliver on something that is new)

- Decision making process

- How are raises calculated and awarded?

- Functional and Non functional requirements?

- Career Path / Engineering Competency Matrix - https://drive.google.com/open?id=131XZCEb8LoXqy79WWrhCX4sBnGhCM1nAIz4feFZJsEo

- What do the day-to-day responsibilities of the role look like?

- What are the company's values? What characteristics do you look for in employees in order to represent those values?

- What's your favorite part about working at the company?

- What does success look like in this position, and how do you measure it?

- Are there opportunities for professional development? If so, what do those look like?

- Who will I be working most closely with?

- What do you see as the most challenging aspect of this job?

- Is there anything about my background or resume that makes you question whether I am a good fit for this role?

Good Questions for the company

- What would be an ideal candidate for your group/company

- How do you test your software? (dedicated test engineers?)

- How you do peer reviews? (core reviews, branching strategies, methodologies they follow?)

- What programs do you have for continuous education.

- What's the software development process that you use?

- How many projects could I expect to work on in a month?

- What's the process for managing the code?

- How long are the typical sprints?

- How many developers are on the team?

- Do developers get time to learn on the job?

- Learning initiatives for growing people?

- What's the typical length of a project?

- How are vacation days handled?

- Are there any emergency processes in place? / Disaster Recovery

- How is project management handled?

- Project Management and Task Management Tools

- Are there technical debts in the current architecture/code base?

- How do you tackle technical debt?

- What's your company culture like?

- How is working at this company different from working at others?

- How much discretionary power will I have to take decisions?

- How do you manage Documentation / Knowledge base?

Question to Team

- Tech Stack

- Python 3

- Latest codebase

- Codebase should be clean

- Technical Debt

- VCS - git / github (so that my contributions can be added to my profile)

- Containerization

- CI/CD pipelines

- Open source contributions/repositories

- Do you use chaos testing (resiliency tool / Fault injection)

- Team Size

- Data flow / data pipeline architecture

- Architecture diagram

- User flows

- Different modules/components

- What are tools/technologies you are using

- Different types of storage

- Different teams (data science / data collection / backend / frontend)

- On cloud / on premise

Startup Questions

- Background of founders before joining company

- Do you have product-market fit? - If not, they don't have real money, and there's no guarantee they ever will.

- What is your current growth rate?

- What is your runway? - The longer the runway, the more financially stable the company is. "Cashrunway" refers to the length of time in which a company will remain solvent, assuming that they are unable to raise more money.

- What's the company's/department's strategy for the next 6-18 months

- Keep the title & position of the interviewer in mind

Check about company

- tofler.in

- glassdoor

- crunchbase

- Talk to previous ex-employees and some existing employees

How to ask for raise / Salary negotiation

- Problem - I want a 20% raise, I did my research and my average salary should be 20% more. The positioning of the question, leaves the employer with a yes or no choice

- Go the boss in the middle of this continuum. I worked here for two and a half years. I have been here through the high times and low times. You know I am loyal. My aspirations are to stay here and grow with the organization. Can you help me figure out a path that gets me to this salary.

- It's not a yes or no game, it's allowing for conversation, it's allowing somebody to recognize that you view your own career with the organization, can you invest in me, can you take a bet on me, rather than meet my demands.

- Therefore a lot of these things fail because they're poorly presented

EXACTLY How To Negotiate Your Salary: Watch and Learn - YouTube

EXACTLY How to Negotiate Your Salary (4 Steps) - YouTube

- Never go first

- Hold your reaction

- Change the playground

- Know your bracket