Nifty Indexes / Indices

Categories

- Broad based Indices

- Sectoral Indices

- Thematic Indices

- Strategy Indices

- G-SEC Indices

- Sovereign Green Bond Indices

- SDL Indices

- Corporate Bond Indices

- Municipal Bond Indices

- Money Market Indices

- Target Maturity Indices

- Fixed Income Aggregates

- Multi Asset

Broad Based Indices

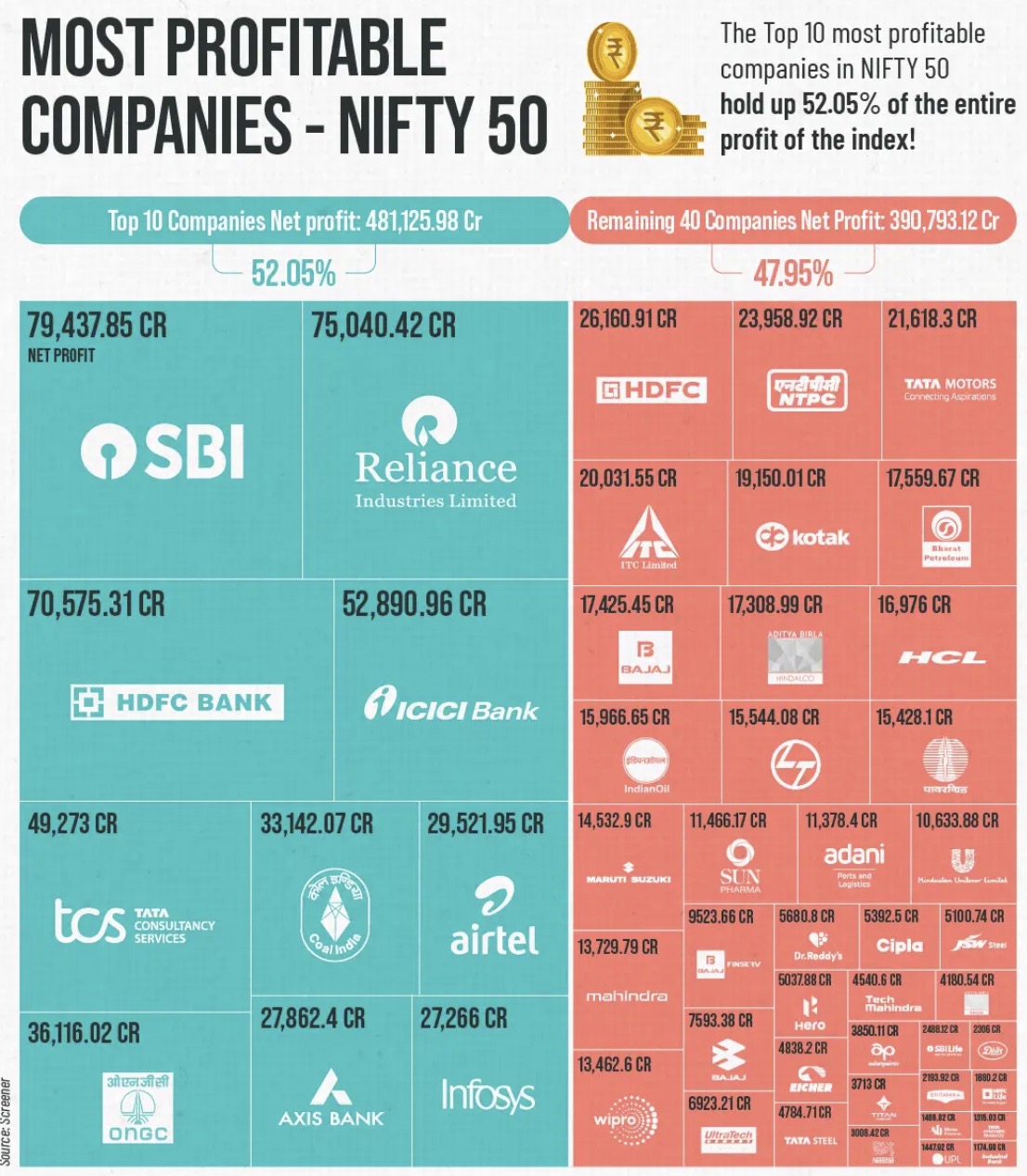

- Nifty 50

- Nifty Next 50

- Nifty 100

- Nifty 200

- Nifty Total Market

- Nifty 500

- Nifty500 Multicap 50:25:25

- Nifty500 LargeMidSmall Equal-Cap Weighted

- Nifty Midcap150

- Nifty Midcap 50

- Nifty Midcap Select

- Nifty Midcap 100

- Nifty Smallcap 250

- Nifty Smallcap 50

- Nifty Smallcap 100

- Nifty Microcap 250

- Nifty LargeMidcap 250

- Nifty MidSmallcap 400

Nifty Next 50 or Nifty Midcap 150: Which is a better bet?

Nifty vs Nifty Next 50 vs Nifty Midcap 150 vs Nifty Smallcap 250

Nifty vs Nifty Next 50 vs Nifty Midcap 150 vs Nifty Smallcap 250

What Is NIFTY Midcap 150? How Can You Invest In This Midcap Index?

Nifty 50 vs Nifty Next 50 vs Nifty 100: Pick Your Large Cap Index

Nifty 50: The Nifty 50 comprises the 50 largest and most liquid companies listed on the National Stock Exchange of India. The stocks in the Nifty 50 are big players, typically large-cap stocks with a massive market value.

Nifty Next 50: On the other hand, the Nifty Next 50 includes mid-cap companies that rank from 51 to 100 in terms of full market cap. So naturally, the average market cap of these companies is smaller than that of Nifty 50 constituents. The total market cap of the Nifty Next 50 is around 15-18% of the full NSE 500 market cap.

- Junior BeES, officially known as Nippon India ETF Nifty Next 50 Junior BeES, is an exchange-traded fund (ETF) that tracks the Nifty Next 50 Index. This index comprises the 50 companies ranked immediately after the Nifty 50 in terms of market capitalization. Therefore, Junior BeES primarily invests in large-cap companies that are potential candidates to enter the Nifty 50. It does not focus on mid-cap stocks.

Nifty 100: Finally, the Nifty 100 is an index that combines the Nifty 50 and Next 50, covering the 100 most valuable listed companies. As you can expect, the market cap is between Nifty 50 and Next 50. So it covers around 75-80% of the total market cap of the 500 stocks trading on the NSE.

Nifty Next 50 vs Nifty Midcap 150: While the Nifty Next 50 is made up of 50 companies ranked 51-100 by marketcap, the Nifty Midcap 150 index consists of 150 companies ranked 101-250.

Nifty vs Nifty Next 50 vs Nifty Midcap 150 vs Nifty Smallcap 250: Return Comparison Sep 2025

Sectoral Indices

- Nifty Auto

- Nifty Bank

- Nifty Financial Services

- Nifty Financial Services 25/50

- Nifty Financial Services Ex Bank

- Nifty FMCG

- Nifty Healthcare

- Nifty IT

- Nifty Media

- Nifty Metal

- Nifty Pharma

- Nifty Private Bank

- Nifty PSU Bank

- Nifty Realty

- Nifty Consumer Durables

- Nifty Oil and Gas

- Nifty MidSmall Financial Services

- Nifty MidSmall Healthcare

- Nifty MidSmall IT & Telecom

Thematic Indices

- Nifty India Corporate Group Index - Aditya Birla Group

- Nifty Commodities

- Nifty Core Housing

- Nifty CPSE

- Nifty Energy

- Nifty EV & New Age Automotive

- Nifty Housing

- Nifty India Consumption

- Nifty India Defence

- Nifty India Digital

- Nifty India Manufacturing

- Nifty Infrastructure

- Nifty India Corporate Group Index - Mahindra Group

- Nifty Midcap Liquid 15

- Nifty MidSmall India Consumption

- Nifty MNC

- Nifty Mobility

- Nifty PSE

- Nifty REITs & InvITs

- Nifty Non-Cyclical Consumer

- Nifty Services Sector

- Nifty Shariah 25

- Nifty India Corporate Group Index - Tata Group

- Nifty India Corporate Group Index - Tata Group 25% Cap

- Nifty Transportation & Logistics

- Nifty100 Liquid 15

- Nifty50 Shariah

- Nifty500 Shariah

- Nifty500 Multicap India Manufacturing 50:30:20

- Nifty500 Multicap Infrastructure 50:30:20

- Nifty SME Emerge

- Nifty100 ESG

- Nifty100 Enhanced ESG

- Nifty100 ESG Sector Leaders

Strategy Indices

- Nifty100 Equal Weight

- Nifty100 Low Volatility 30

- Nifty 50 Arbitrage

- Nifty 50 Futures PR

- Nifty 50 Futures TR

- Nifty200 Momentum 30

- Nifty200 Alpha 30

- Nifty100 Alpha 30

- Nifty Alpha 50

- Nifty Alpha Low Volatility 30

- Nifty Alpha Quality Low Volatility 30

- Nifty Alpha Quality Value Low Volatility 30

- Nifty Dividend Opportunities 50

- Nifty Growth Sectors 15

- Nifty High Beta 50

- Nifty Low Volatility 50

- Nifty100 Quality 30

- Nifty Midcap150 Momentum 50

- Nifty500 Momentum 50

- Nifty Midcap150 Quality 50

- Nifty Smallcap250 Quality 50

- Nifty MidSmallcap400 Momentum Quality 100

- Nifty Smallcap250 Momentum Quality 100

- Nifty Quality Low Volatility 30

- Nifty50 Dividend Points

- Nifty50 Equal Weight

- Nifty50 PR 1x Inverse

- Nifty50 PR 2x Leverage

- Nifty50 TR 1x Inverse

- Nifty50 TR 2x Leverage

- Nifty50 Value 20

- Nifty500 Value 50

- Nifty500 Equal Weight

- Nifty200 Quality 30

- Nifty50 & Short Duration Debt – Dynamic P/B

- Nifty50 & Short Duration Debt – Dynamic P/E

- Nifty Equity Savings