6A: Ratio Analysis

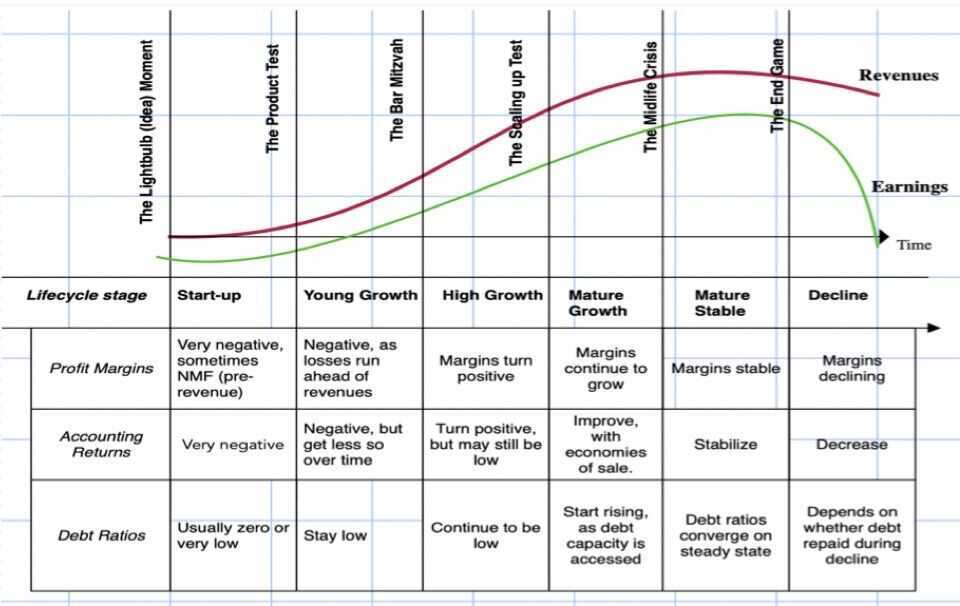

Financial Ratios: A Life Cycle Perspective

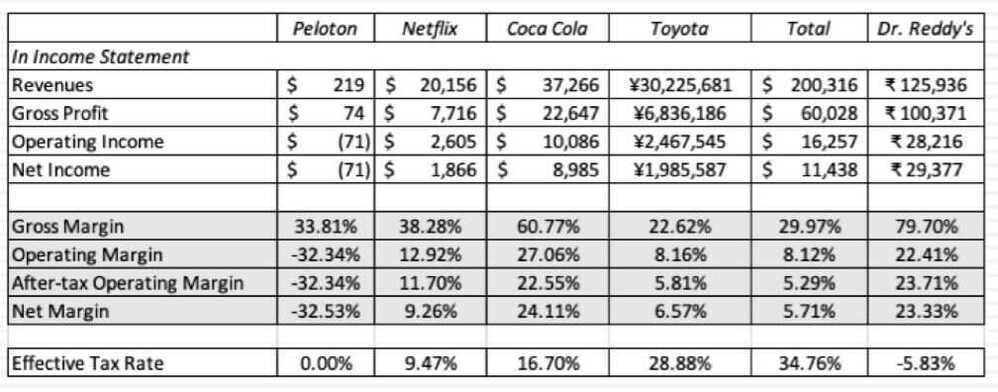

Profitability Ratios

And analysis

- Young to old: Young companies often have negative or very low margins, for two reasons

- They are still building up their revenues

- Some of their operating expenses are associated with future growth, not current operations

- Business Differences: High gross margin businesses have the advantage: Companies like Coca Cola (brand name consumer product) and Dr. Reddy's Labs (pharmaceutical) start with sky-high gross margins, which then feed into high operating and net margins

- Leverage Effects: Companies with high debt ratios can have low net margins, while operating margins stay high

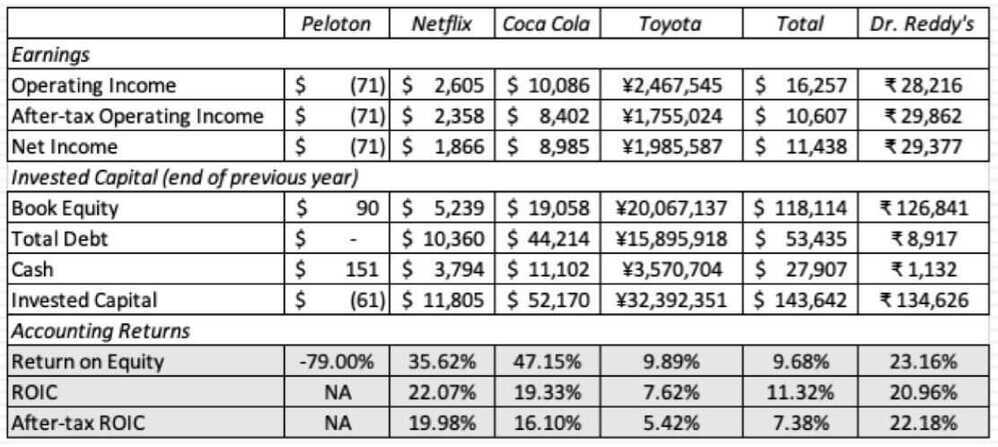

Accounting Returns

Reflections of

- Competitive Advantages: If accounting returns are fair measure of true returns, they are the repository for competitive advantages.

- Industries where barriers to entry are high or other competitive advantages prevail should have higher returns on capital than companies without these advantages

- Companies with strong competitive advantages within an industry should earn higher returns than their peer group

- Accounting choices and inconsistencies: Accouting can affect and sometimes skew returns

- By misclasifying capital, operating and financial expenses

- By taking write offs to reflect mistakes made in the past

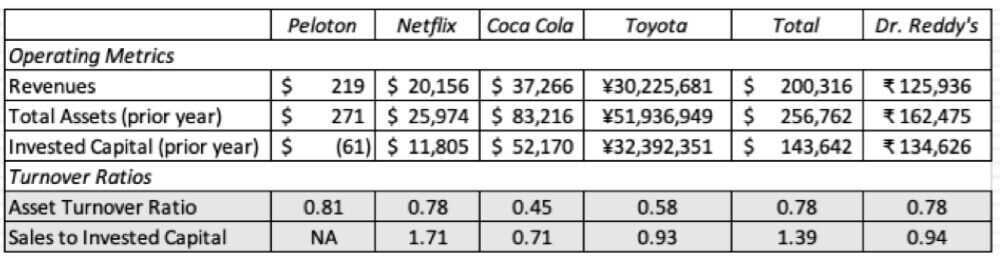

Efficiency Ratios

The dark side of growth

- The growth trade off: Growth has a good side, insofar as it lets a company scale up its operations, but it has a dark side, which is that companies have to reinvest to deliver that growth

- Scaling up measure: Turnover ratios look at the link between what a company has to reinvest, and how much its revenues grow over time. Companies that are more efficient on this measure will be able to grow revenues, with less reinvestment

- Young to old: The link between company age and turnover ratios will vary across different business types, with older companies becoming more efficient in some, and less in others

- Accouting effects: The problems associated with accouting choices and inconsistencies will affect turnover ratios as well

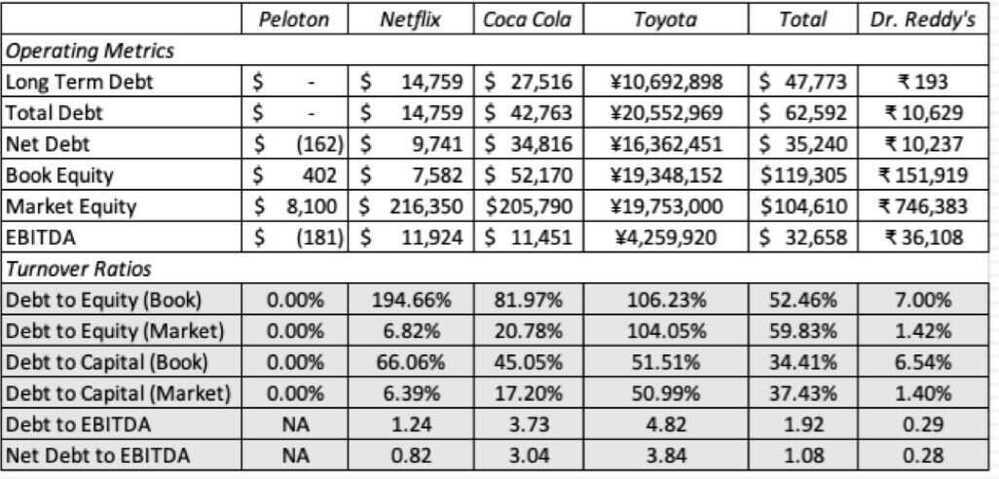

Debt Ratios

Debt, the double edged sword

- Source of capital: Debt is source is capital for a business, just as equity is. There is nothing inherently good or bad about it, but in most parts of the world, it is a trade off between tax benefits that accrue to borrowing and distress risk

- Measurement choices: When comparing across companies, you have to measure debt consistently across companies. However, it is usually better to focus on

- Total debt, rather than a subset of debt

- Market value, rather than book value

- Gross vs Net Debt: While the rationale for nettting cash out from debt is impeccable, cash is a transient asset, here today and can be gone tomorrow

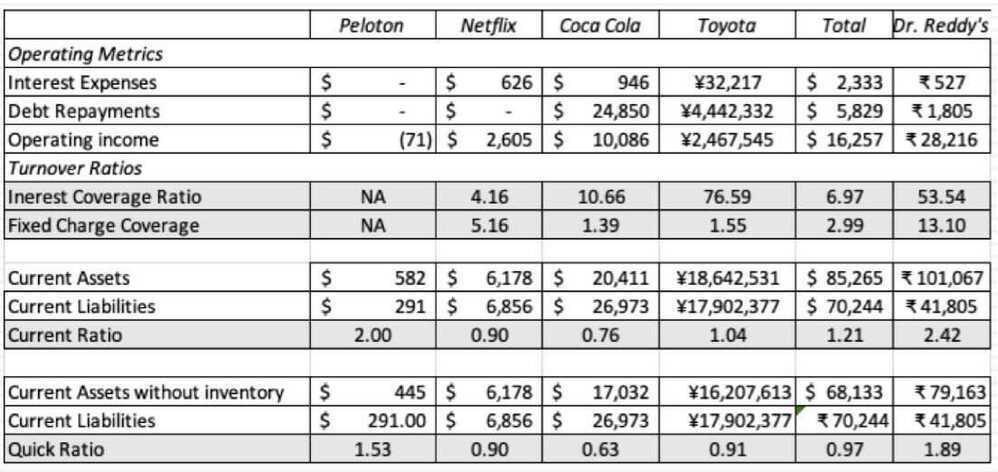

Coverage & Liquidity Ratios

And analysis

- Safety in numbers: All else held equal, companies that score higher on interest and fixed charge coverage ratios should have more buffer than companies that score lower

- Normalization: That said, the ratios can be skewed by year-to-year changes, especially in operating income and debt depayments

- For companies in volatile businesses, this can translate into big swings in coverage ratios from good to bad years. The solution is to use an average across time

- For young companies, the coverage ratios can look bad, at least as they start the growth process, but these companies can grow operating income quickly to gain buffers

Final Thoughts

-

Less is more

If you decide to use financial ratios, less is more. Choose the ratios that you want, rather than create noise by computing multiple ratios

-

A means to an end

Ratios, by themselves, are just numbers and mean nothing, unless you use them to make judgements about what your company does well or badly, and how this affects your perspective for the company

-

Past versus future

While your ratios are in the past, investing and corporate finance are about the future