Income Tax

| Income Tax Slabs | Tax Rate for Individual & HUF Below the Age Of 60 Years |

|---|---|

| Up to ₹2,50,000* | Nil |

| ₹2,50,001 to ₹5,00,000 | 5% of total income exceeding ₹2,50,000 |

| ₹5,00,001 to ₹10,00,000 | ₹12,500 + 20% of total income exceeding ₹5,00,000 |

| Above ₹10,00,000 | ₹1,12,500 + 30% of total income exceeding ₹10,00,000 |

- An additional 4% Health & education cess will be applicable on the tax amount calculated as above.

- Surcharge: 10% of income tax, where total income exceeds Rs.50 lakh up to Rs.1 crore.

- Surcharge: 15% of income tax, where the total income exceeds Rs.1 crore.

- Surcharge of 25% on Total Income more than Rs. 2 Cr to Rs. 5 crore

- Surcharge of 37% on Total Income more than Rs. 5 Cr

So ~3cr or 2% of Indians out of 140cr invest.

ITR filings for FY 20/21 by income.

- ~4.8cr ₹5lks

- ~90lks ₹5 to ₹10lks

- ~43lks ₹10lks

If people have to invest or spend more, they need to earn at least ₹2.5lks/yr?

Incomes exempt from paying tax

- Income from Agriculture (Agriculture Income)

- Gifts Received from Relatives

- Income from Gratuity

- Scholarships

- Certain Pensions - Pensions received by recipients of gallantry awards like the Mahavir Chakra, Param Vir Chakra, and Vir Chakra are tax-free. Additionally, the pension received by family members of Indian Armed Forces personnel is also exempt from tax.

Certain Pensions | Zee Business

Gratuity

- Lifetime Cumulative Limit: The ₹20 lakh limit for private sector employees is a cumulative, lifetime cap across all employers.

- Taxable Portion: Any gratuity amount received above the applicable exemption limit is fully taxable as "Income from Salary".

- Minimum Service: Generally, an employee must complete a minimum of five years of continuous service to be eligible for gratuity payment (the condition is waived in case of death or disablement).

- Income Tax Exemption on Gratuity

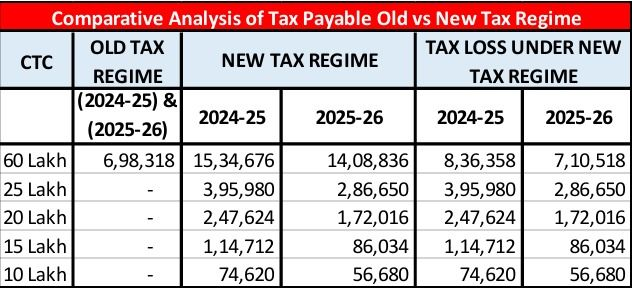

New Tax Regime vs Old Tax Regime

The Old Tax Regime is almost dead

Taxation Comparison

Rs 10 Crore salary after taxes

- USA: 37% → ₹6.3 CR

- China: 45% → ₹5.5 CR

- Japan: 55.97% → ₹4.4 CR

- Germany: 45% → ₹5.5 CR

- India: 42.74% → ₹5.7 CR

- UK: 45% → ₹5.5 CR

- France: 55.4% → ₹4.5 CR

- Italy: 47.2% → ₹5.3 CR

- Brazil: 27.5% → ₹7.25 CR

- Canada: 33% → ₹6.7 CR

- Russia: 13% → ₹8.7 CR

- S. Korea: 45% → ₹5.5 CR

- Australia: 45% → ₹5.5 CR

- Spain: 54% → ₹4.6 CR

- Mexico: 35% → ₹6.5 CR

- Indonesia: 35% → ₹6.5 CR

- Netherlands: 49.5% → ₹5.05 CR

- Saudi Arabia: 0% → ₹10 CR

- Turkey: 40% → ₹6 CR

- Switzerland: 40% → ₹6 CR

- Taiwan: 40% → ₹6 CR

- Poland: 36% → ₹6.4 CR

- Sweden: 52.3% → ₹4.77 CR

- Belgium: 53.5% → ₹4.65 CR

- Thailand: 35% → ₹6.5 CR

- Argentina: 35% → ₹6.5 CR

- Austria: 55% → ₹4.5 CR

- Norway: 39.6% → ₹6.04 CR

- UAE: 0% → ₹10 CR

- Israel: 50% → ₹5 CR

- South Africa: 45% → ₹5.5 CR

- Malaysia: 30% → ₹7 CR

- Denmark: 55.9% → ₹4.41 CR

- Singapore: 22% → ₹7.8 CR

- Philippines: 35% → ₹6.5 CR

- Ireland: 52% → ₹4.8 CR

- Vietnam: 35% → ₹6.5 CR

- Hong Kong: 15% → ₹8.5 CR

- Chile: 40% → ₹6 CR

- New Zealand: 39% → ₹6.1 CR

- Finland: 56.9% → ₹4.31 CR

- Colombia: 39% → ₹6.1 CR

- Portugal: 48% → ₹5.2 CR

- Czechia: 23% → ₹7.7 CR

- Hungary: 15% → ₹8.5 CR

- Greece: 45% → ₹5.5 CR

- Ecuador: 35% → ₹6.5 CR

- Peru: 30% → ₹7 CR

Rs 10 crore salary: How much you take home in US vs India vs UAE vs Finland? Here's a comparison

Links

- Got an income tax notice? Here are common types of tax notices and what to do to avoid penalties - The Economic Times

- Filing ITR for FY2024-25? Mistakes in HRA claims, capital gains tax calculation are among 7 errors to avoid - The Economic Times

- You do not pay 30% tax if you fall in the 30% slab! Marginal vs. effective tax rate