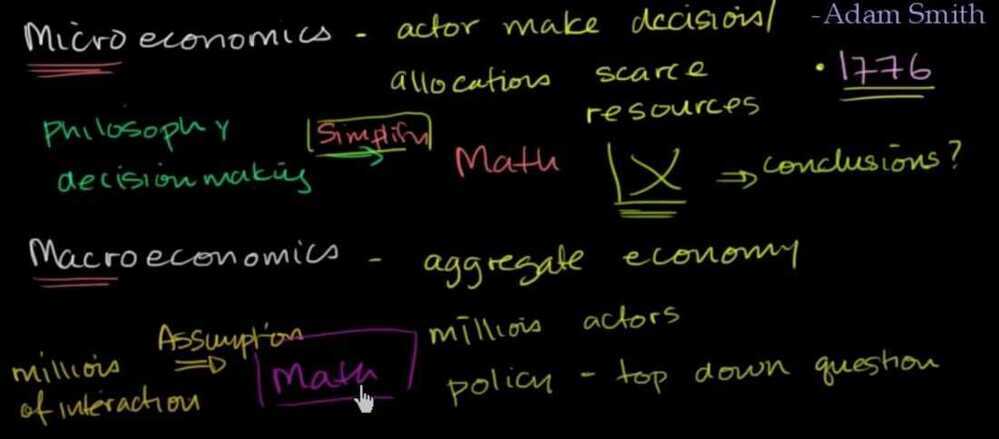

Macroeconomics

Macroeconomics (from the Greek prefix makro-meaning "large" +economics) is a branch of economics dealing with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study aggregated indicators such as GDP, unemployment rates, national income, price indices, and the interrelations among the different sectors of the economy to better understand how the whole economy functions. They also develop models that explain the relationship between such factors as national income, output, consumption, unemployment, inflation, saving, investment, international trade, and international finance.

While macroeconomics is a broad field of study, there are two areas of research that are emblematic of the discipline: the attempt to understand the causes and consequences of short-run fluctuations in national income (the business cycle), and the attempt to understand the determinants of long-run economic growth(increases in national income).Macroeconomic models and their forecasts are used by governments to assist in the development and evaluation of economic policy.

- What will we produce?

- How will we produce it?

- Who gets it?

https://en.wikipedia.org/wiki/Macroeconomics

Money Supply / Money Stock

In macroeconomics, the money supply(ormoney stock) refers to the total volume of money held by the public at a particular point in time in an economy. There are several ways to define "money", but standard measures usually include currency in circulation and demand deposits(depositors' easily accessed assets on the books of financial institutions). The central bank of each country may use a definition of what constitutes money for its purposes.

Money supply data is recorded and published, usually by the government or the central bank of the country.Public and private sector analysts monitor changes in the money supply because of the belief that such changes affect the price levels of securities, inflation, the exchange rates, and the business cycle.

The relationship between money and prices has historically been associated with the quantity theory of money. There is strong empirical evidence of a direct relationship between the growth of the money supply and long-term price inflation, at least for rapid increases in the amount of money in the economy.For example, a country such as Zimbabwe which saw extremely rapid increases in its money supply also saw extremely rapid increases in prices (hyperinflation). This is one reason for the reliance on monetary policy as a means of controlling inflation.

The Reserve Bank of India defines the monetary aggregates as:

- Reserve money(M0): Currency in circulation, plus bankers' deposits with the RBI and 'other' deposits with the RBI. Calculated from net RBI credit to the government plus RBI credit to the commercial sector, plus RBI's claims on banks and net foreign assets plus the government's currency liabilities to the public, less the RBI's net non-monetary liabilities. M0 outstanding was ₹30.297 trillion as on March 31, 2020.

- M1: Currency with the public plus deposit money of the public (demand deposits with the banking system and 'other' deposits with the RBI). M1 was 184 per cent of M0 in August 2017.

- M2: M1 plus savings deposits with post office savings banks. M2 was 879 per cent of M0 in August 2017.

- M3 (the broad concept of money supply): M1 plus time deposits with the banking system, made up of net bank credit to the government plus bank credit to the commercial sector, plus the net foreign exchange assets of the banking sector and the government's currency liabilities to the public, less the net non-monetary liabilities of the banking sector (other than time deposits). M3 was 555 per cent of M0 as on March 31, 2020(i.e.₹167.99 trillion.)

- M4: M3 plus all deposits with post office savings banks (excluding National Savings Certificates).

New Monetary Aggregates

The RBI has started publishing a set of new monetary aggregates following the recommendations of the Working Group on Money Supply: Analytics and Methodology of Compilation (Chairman: Dr. Y.V. Reddy) which submitted its report in June 1998.

The Working Group recommended compilation of four monetary aggregates on the basis of the balance sheet of the banking sector in conformity with the norms of progressive liquidity:

- NM0 (monetary base)

- NM1 (narrow money)

- NM2

- NM3 (broad money)

https://www.clearias.com/monetary-aggregates

https://en.wikipedia.org/wiki/Money_supply

https://www.investopedia.com/terms/m/moneysupply.asp

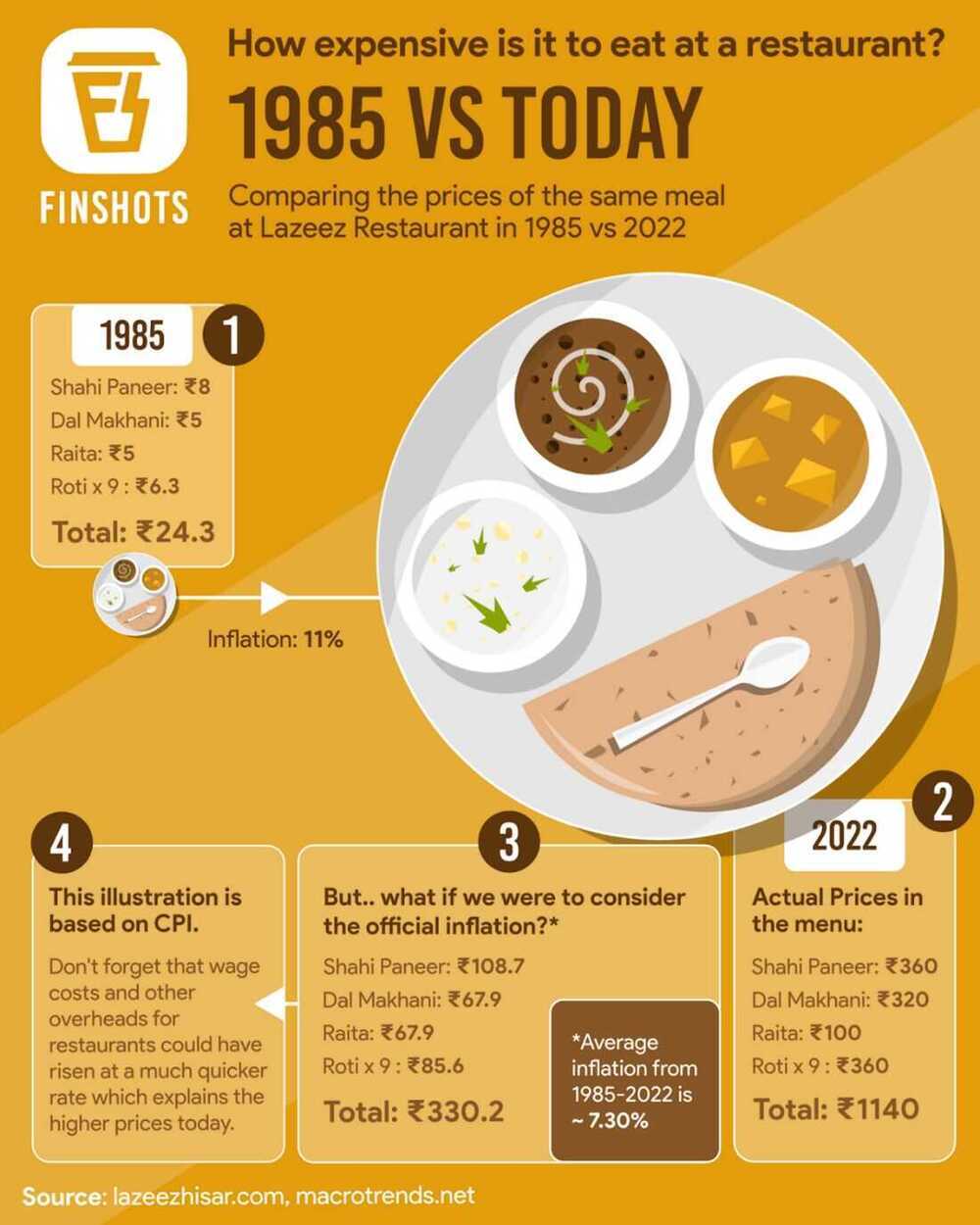

Inflation

Why inflation occurs - Too much money chasing too few goods

People are spending more instead of saving, losing trust on paper money and parking money in assets

Demand pull inflation

Demand-pull inflation is the upward pressure on prices that follows a shortage in supply, a condition that economists describe as "too many dollars chasing too few goods."

- When demand surpasses supply, higher prices are the result. This is demand-pull inflation.

- A low unemployment rate is unquestionably good in general, but it can cause inflation because more people have more disposable income.

- Increased government spending is good for the economy, too, but it can lead to scarcity in some goods and inflation will follow.

https://www.investopedia.com/terms/d/demandpullinflation.asp

Cost push inflation

- Cost-push inflation occurs when overallprices increase (inflation) due to increases in the cost of wages and raw materials.

- Cost-push inflation can occur when higher costs of production decrease the aggregate supply (the amount of total production) in the economy.

- Since the demand for goods hasn't changed, the price increases from production are passed onto consumers creating cost-push inflation.

The wage-price spiral is a take on cost-push inflation argues that as wages rise, it creates more demand, which leads to higher prices. These higher prices thus incentivize workers to demand even higher wages, and so the cycle repeats.

https://www.investopedia.com/terms/c/costpushinflation.asp

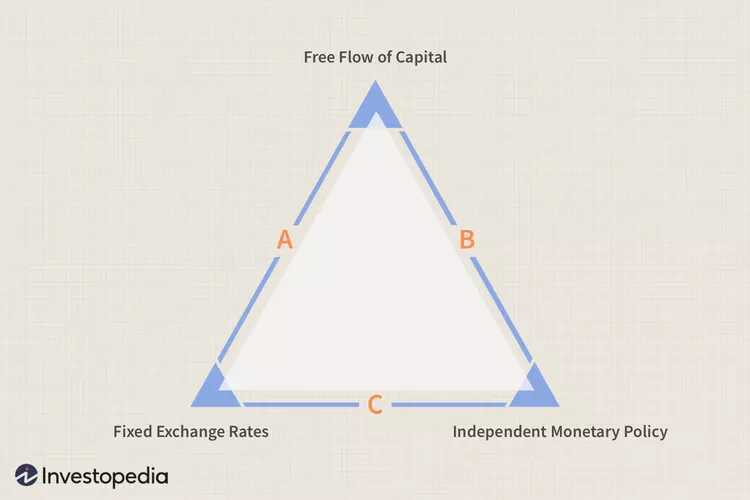

Impossible trinity / Impossible Trilemma / Bretton Woods trilemma

The impossible trinity (also known as the impossible trilemma or the Unholy Trinity) is a concept in international economics which states that it is impossible to have all three of the following at the same time:

- a fixed foreign exchange rate

- free capital movement (absence of capital controls)

- an independent monetary policy

- Side A: A country can choose to fix exchange rates with one or more countries and have a free flow of capital with others. If it chooses this scenario, independent monetary policy is not achievable because interest rate fluctuations would create currency arbitrage stressing the currency pegs and causing them to break.

- Side B: The country can choose to have a free flow of capital among all foreign nations and also have an autonomous monetary policy. Fixed exchange rates among all nations and the free flow of capital are mutually exclusive. As a result, only one can be chosen at a time. So, if there is a free flow of capital among all nations, there cannot be fixed exchange rates.

- Side C: If a country chooses fixed exchange rates and independent monetary policy it cannot have a free flow of capital. Again, in this instance, fixed exchange rates and the free flow of capital are mutually exclusive.

What Is a Trilemma and How Is It Used in Economics? With Example

Impossible trinity - Wikipedia

Economic Integration vs National Sovereignty vs Democracy

The "Bretton Woods trilemma" is a term used to describe the inherent tensions and trade-offs within the global economic system. It suggests that countries can only achieve a maximum of two out of three key goals: democracy, national sovereignty, and global economic integration. This concept, often associated with the work of Dani Rodrik, highlights the difficulty of balancing the needs of individual nations with the demands of a globalized world.

Here's a more detailed explanation:

- Global Economic Integration: This refers to the increasing interconnectedness of national economies through trade, investment, and capital flows.

- National Sovereignty: This refers to a nation's right to govern itself and make its own decisions without external interference, particularly in matters of economic policy.

- Democracy: This refers to a political system where power is held by the people and exercised through elected representatives.

The trilemma suggests that achieving all three of these goals simultaneously is essentially impossible. For example, embracing greater global economic integration might necessitate sacrificing national sovereignty or democratic control over certain economic policies, and vice versa.

The ‘political trilemma’ and the crisis in the West - The Hindu

Demographic Crisis

Demographic crisis - the impact of an aging society - YouTube

India

Indian Influencers Are WRONG About India! - YouTube

Lies You've Been Told About INDIA & The Truth You Need to Know! - YouTube

Seeking wisdom in the Indian Stock Markets | SOIC

Tools

The Atlas of Economic Complexity

Others

- The debt-money-economic dynamic

- The internal conflict dynamic

- The external conflict dynamic

- Acts of nature (droughts, floods, and pandemics)

- Human invention and technology development

Links

- Finshots Recap - The best stories on economics

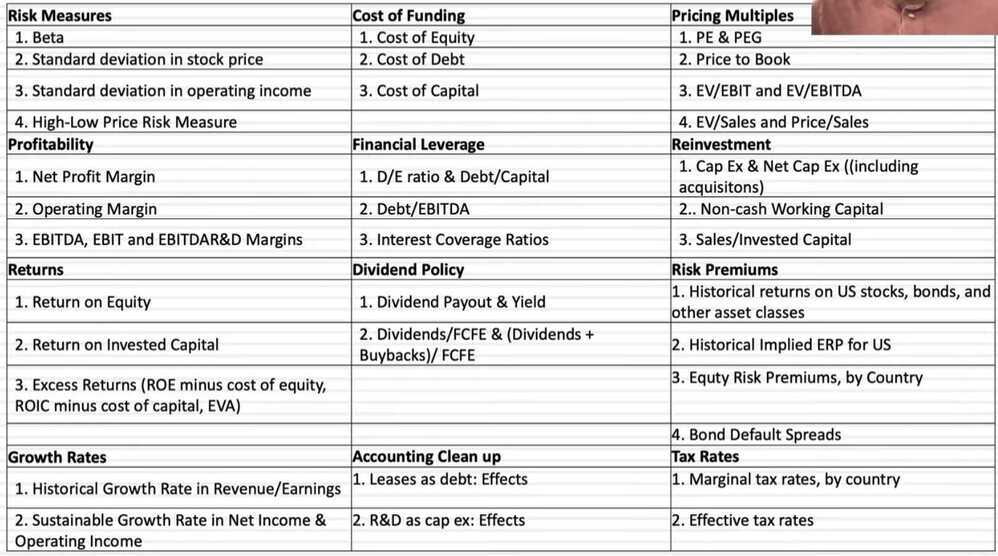

- Data Update 1 for 2023: Setting the table

- Data Update 4 for 2023: Country Risk

- Data Update 5 for 2023: Profitability, Returns and Value

- Data Update 6 for 2023: The Upside and Downside of Debt - YouTube

- Data Update 7 for 2023: Dividends, Buybacks and Cashflows - YouTube

- The Two Big Economics Lies You Still Believe | Economics Explained - YouTube

- Should We Be Worried About The BRICS? | Economics Explained - YouTube

- Did Washing Machines Change The Global Economy More Than The Internet? - YouTube

- The Inequality Problem Nobody Likes To Talk About | Economics Explained

- How the World’s Most Dangerous Country Solved Murder - YouTube

- The Big Economic Problem of Shrinking Cities | Economics Explained - YouTube

- The Next Global Superpower Isn't Who You Think | Ian Bremmer | TED - YouTube

- AI Winners, Losers and Wannabes: Valuing AI's Boost to NVIDIA's Value! - YouTube

- Why Is Europe Always Lagging Behind The US? | Economics Explained - YouTube

- How Corruption Led to Lebanon's Brutal Collapse - YouTube

- Finland Redefines Economic Success | Economics Explained - YouTube

- That Time the Soviets Tried to Abolish Money - YouTube

- The Growing Revolt Against the US Dollar - YouTube

- What Everyone Gets Wrong About Global Debt | Economics Explained - YouTube

- Ray Dalio Explains How the U.S. Economic Crisis is Unfolding. - YouTube

- Age of Easy Money (full documentary) | FRONTLINE - YouTube

- Stories from 2008's Great Recession | 60 Minutes Full Episodes - YouTube

- How Finance Works: The HBR Guide to Thinking Smart About the Numbers - Mihir Desai - YouTube

- This Company Printed Your MONEY!! The Hidden Story!! - YouTube

- End of the Road: How Money Became Worthless - YouTube

- Country Risk: A 2023 Mid-year Update - YouTube

- What’s Happening with the Economy? The Great Wealth Transfer

- Skills Wars Are The New Trade Wars | Economics Explained - YouTube

- Should The USA Isolate To Save Its Economy? | Economics Explained - YouTube

- Worst Cases of Hyperinflation: What It’s Like & How To Survive!! - YouTube

- The Game Theory Of Military Spending | Economics Explained - YouTube

- China Needs to Engineer a Beautiful Deleveraging

- In Search of Safe Havens: The Trust Deficit and Risk-free Investments! - YouTube

- Why Indian Economy is Bleeding Talent? : Socio-economic case study - YouTube

- When Economic Policies Go Wrong | Economics Explained - YouTube

- Why the Rich World is Dying and How to Save It - YouTube

- How The UN Destroyed Iraq For Oil | Epic Economics - YouTube

- Watch Out! They’re LYING To You About Inflation & The Economy!! - YouTube

- The Thinking Behind Why Cash Is Now Good (and not Trash)

- Post Labor Economics: How will the economy work after AGI? Recent thoughts and conversations - YouTube - Status game, Status economy

- This Bank Predicted Everything 20 Years Ago - YouTube

- Plutonomy refers to an economic system where wealth is concentrated in the hands of a few, whereas plutocracy is a political system where a country is ruled by the wealthy

- Person of the Year 2023 by Navneet Munot

- Something Terrible Is Happening in France | Economics Explained - YouTube

- 2024: A Pivotal Year on the Brink | Ray Dalio | LinkedIn

- Are We in a Stock Market Bubble?

- Mukesh Ambani’s smooth succession plan, to avoid battle he had with brother Anil - YouTube

- In China: The 100-Year Storm on the Horizon and How the Five Big Forces Are Playing Out

- How I Made Millions As The World’s Best Trader | Minutes With - YouTube

- The Loss Of Trust In The Democratic Party And Next Steps

- To Answer the Question of Why I Invest in China

- Country Risk: The 2024 Update - YouTube

- Compute and the role it plays in AI

- Americans Distrusting Capitalism!! | Lessons For India?? | Deshbhakt Conversation With Ruchir Sharma - YouTube

- Where Will the Money and Productivity Come From?

- Fed up with Fed Talk: Central Banking Fairy Tales and Facts! - YouTube

- ‘Capitalism Without Capital’ Finds Strength in India - Marcellus

- A Beautiful Deleveraging with Chinese Characteristics?

- How Countries Go Broke: The Big Cycle In a 5-Minute Read

- Lower wages, aging population, but still prospering: How Japan is quietly showing the world how to grow without economic growth - The Economic Times

- WARNING: Gold Prices Are Signaling a Major Crash… - YouTube

- The Big Dangers of Big Bubbles with Big Wealth Gaps

- Ray Dalio - 2025

- Yuval Noah Harari: Stories, Power & Why Truth Doesn't Matter | Nikhil Kamath | People by WTF - YouTube