Stocks / Equity

The stock market is a device for transferring money from the impatient to the patient - Warren Buffet

Selling stock is as important as buying stock

Don't sell the stocks which gives you high returns, sell the negative or no returns stock

Equity risk premium

Stocks are forward looking

Taxes on ETF / Equity Mutual Funds

Long-term capital gains from the transfer of equity shares (listed and non-listed) or from stake sales in a startup can be avoided under section 54F of the Income Tax Act, 1961, if the gains are invested in residential property.

You can claim exemption against any long-term capital gains tax liability if you invest the net sale proceeds of such capital asset for buying a residential house within two years or get a residential house constructed within three years from the date of sale of such asset. One can claim this exemption even if you have already purchased a house within one year prior to sale of long-term capital gains asset.

Screener

- https://www.screener.in/explore

- https://www.screener.in/screens/103296/52-week-lows

- https://www.screener.in/screens/343087/fii-buying

- https://www.tickertape.in/screener/equity/prebuilt/SCR0001

- https://www.screener.in/screens/218753/marcellus-little-champs

- https://www.screener.in/screens/395078/consistent-compounders-marcellus

- https://www.screener.in/screens/523311/rising-giants-marcellus

- How to use - FIIs are buying this stock | CA Rachana Ranade - YouTube

NiftyETF

Company / Companies

- Adani Energy

- HINDUNILVR

- ASIANPAINT

- PIDILITIND

- TCS

- HDFCBANK

- INFY

- COLPAL

- ITC

- MARICO

- HINDPETRO

- IOC

- COALINDIA

- VEDL

- GODREJCP

- WIPRO

- DABUR

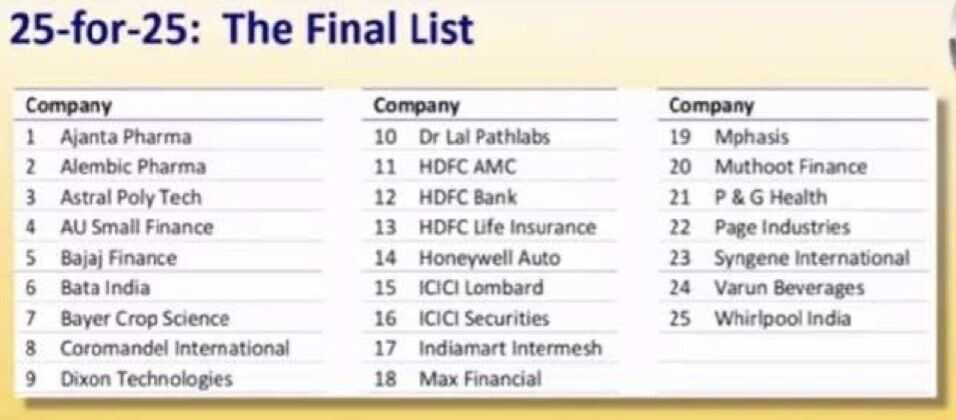

Freefincal direct equity list

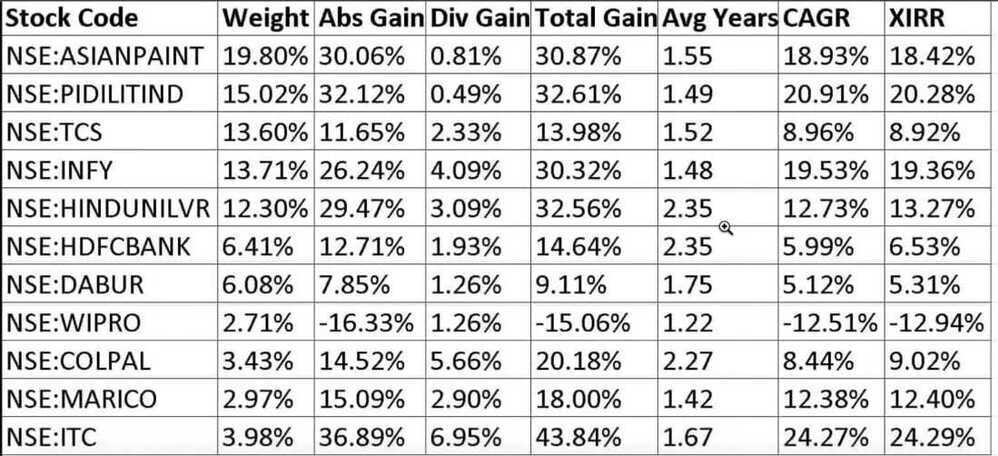

My Stock Portfolio Analysis: July 2025

- Happiest Minds

- Dixon

- V-Guard / Havells

3 Electric vehicle stocks for Long term investments | 3 Best EV Stocks in India | - YouTube

- Mahindra and Mahindra

- Exide

- Tata motors

- Powergrid

- Olectra - electric buses

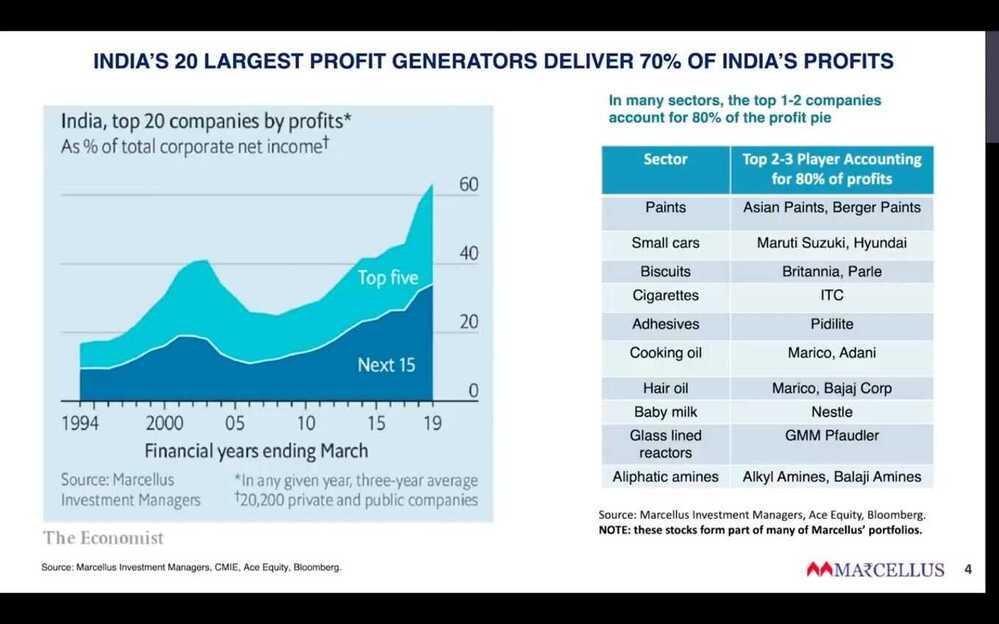

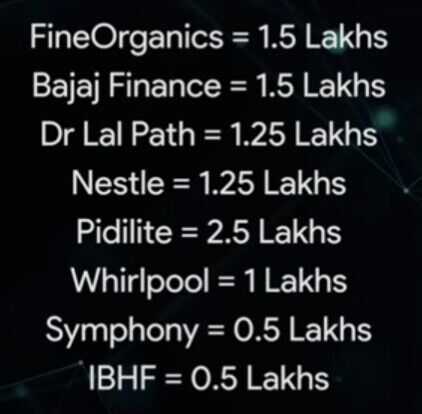

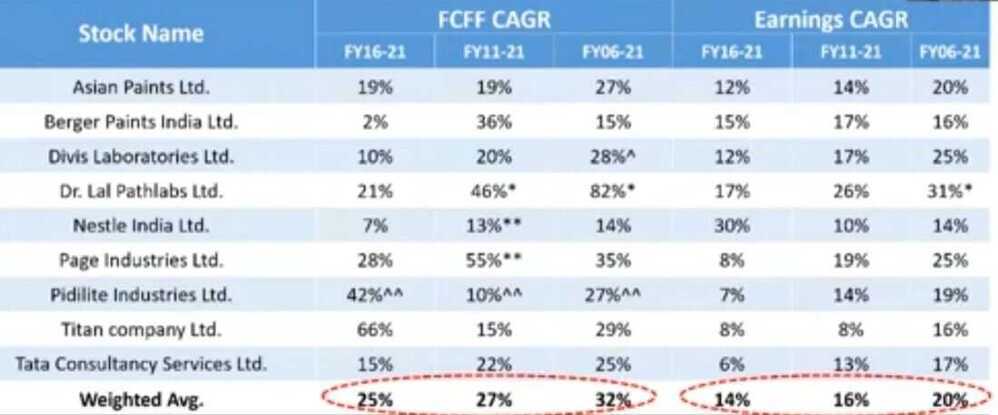

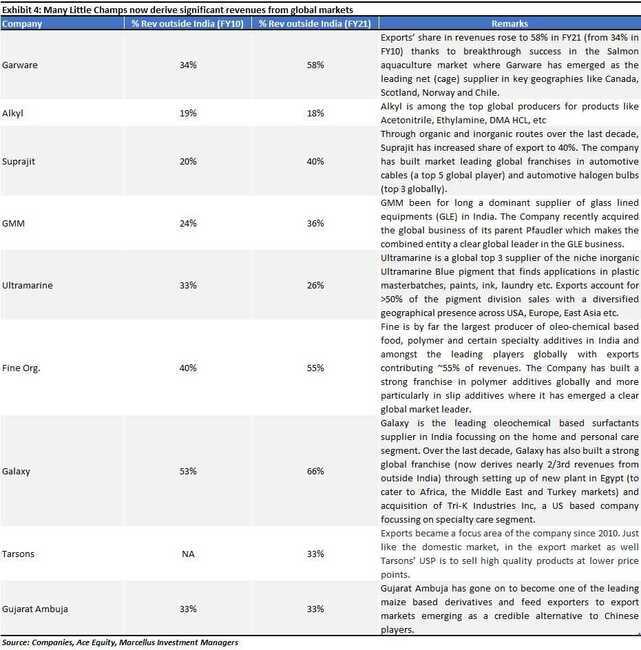

Marcellus

-

Private sector banks

-

Asian Paints and Berger Paints (the most efficient paint manufacturers), Astral Poly (the most efficient CPVC pipe manufacturer), Pidilite (the most efficient adhesives and waterproofing manufacturer) and Titan (the most efficient jeweler).

- HDFC Bank

- Dr Lal PathLabs

- GMM Pfaudler

- Amrutanjan

https://marcellus.in/blogs/three-distinct-layers-of-polarization-in-the-indian-stock-market

10 Fav stocks of mutual funds beyond Nifty50

- Bharat Electronics - Rs. 36,877 cr

- HAL - Rs. 20,961 cr

- PFC - Rs. 20,901 cr

- Zomato - Rs. 19,932 cr

- Avenue Supermarkets - Rs. 19,527 cr

- Interglobe Aviation - Rs. 19,329 cr

- Cummings India - Rs. 17,686 cr

- SBI Life - Rs. 17,645 cr

- TVS Motor - Rs. 17,527 cr

- Motherson - Rs. 15,427 cr

Top retail investors

- Rakesh Jhunjhunwala and Associates

- Premji and Associates

- Radhakishan Damani

- Mukul Agrawal

- Mukul Mahavir Prasad Agarwal

- Rajeev Thakkar - PPFAS - PPFCF

https://www.moneycontrol.com/india-investors-portfolio

Robo Advisor / ETMoney Genius

ET Genius - A marketing gimmic or actually Genius? : r/IndiaInvestments

Learning

SOIC

- Most people make the simple process of Industry Research complex. Here we have simplified the process of Industry research in such a way that even a 5th grade student can understand: How to do Industry Research? Must Watch! - YouTube

- Are you afraid of reading annual reports? Do not worry anymore. Here we have simplified the art of reading an annual report to such an extent that anyone can learn how to read and understand even if you are from a Non-Finance background: How to read an Annual Report: Part 1- Deepak Nitrite, 2020 - YouTube

- Ever wondered why some of the businesses compound your wealth for multiple decades? Learn the art of identifying these patterns with our book review on 100 baggers: the art of multiplying 100x with case studies from the Indian context: 📔100 Baggers Book Review: Indian Case studies (Navin, Kotak, etc.) - YouTube

- One of the simplest way to create wealth in the markets is by following the learnings of Mr. Peter Lynch, who is one of the most famous fund managers and is known widely due to his simplicity. Learn the secrets of how Mr. Peter Lynch invested with our blog about key learnings from his style: Seeking wisdom in the Indian Stock Markets | SOIC

- Learn how our framework has evolved after 6 years of continuous hard work on refining our process. We share it with all of you in this video: Peter Lynch's 10 Bagger Framework & SOIC 5 Bucket Framework - YouTube

Seeking wisdom in the Indian Stock Markets | SOIC

Links

- Contrarian Investing | Is Contrarian Investing Profitable? | ET Money

- 8 Contrarian Investing Strategies | 31% Return from "Portfolio of Losers" | Contra Mutual Funds - YouTube

- Stock Market Investing Strategies - YouTube

- How should Traders & Investors, trade or invest in a Bear Market? - YouTube

- Finshots is a stock-picking genius. But…

- Why portfolio rebalancing is important for investment success

- Mutual Fund Profit Booking vs Rebalancing: What is the difference?

- My Stock Portfolio Analysis: Mar 2024

- SIP Top-Up: The Mindboggling math of SIP top up

- SWP: A smarter way to manage periodic expenses

- Want to time the market? Here is how you can do it right! - YouTube

- How to know if markets are overvalued? 3 metrics every investor must know - YouTube

- Is it the right time to Invest in Stocks? 😵💫 - YouTube

- 5 Interesting Stocks: How to Read Credit Ratings! 📑 - YouTube

- 4 Smallcap Concalls that look interesting - YouTube

- PE Ratio Decoded for Multibaggers 🕵️♂️ - YouTube

- Top 5 Themes for Diwali 5️⃣🧨🪔 - YouTube

- Spotting Winners in Metals & Mining Sector 🏆 - YouTube

- Smart Money is Buying these Stocks! 🏋️♀️ - YouTube

- I do 0 SIPs now. Here is why (5 better strategies...) | Akshat Shrivastava - YouTube

- SOIC Special (Live)- Spotting Mega Themes - YouTube

- The Fallen Multibaggers 🔻 - YouTube

- Spot Bad Stock in 3 Easy Steps - YouTube

- How investors should be thinking as the stock market nears a P/E ratio of 30—a number that spelled disaster before the dotcom crash | Fortune