Key Concepts

Web3 Architecture

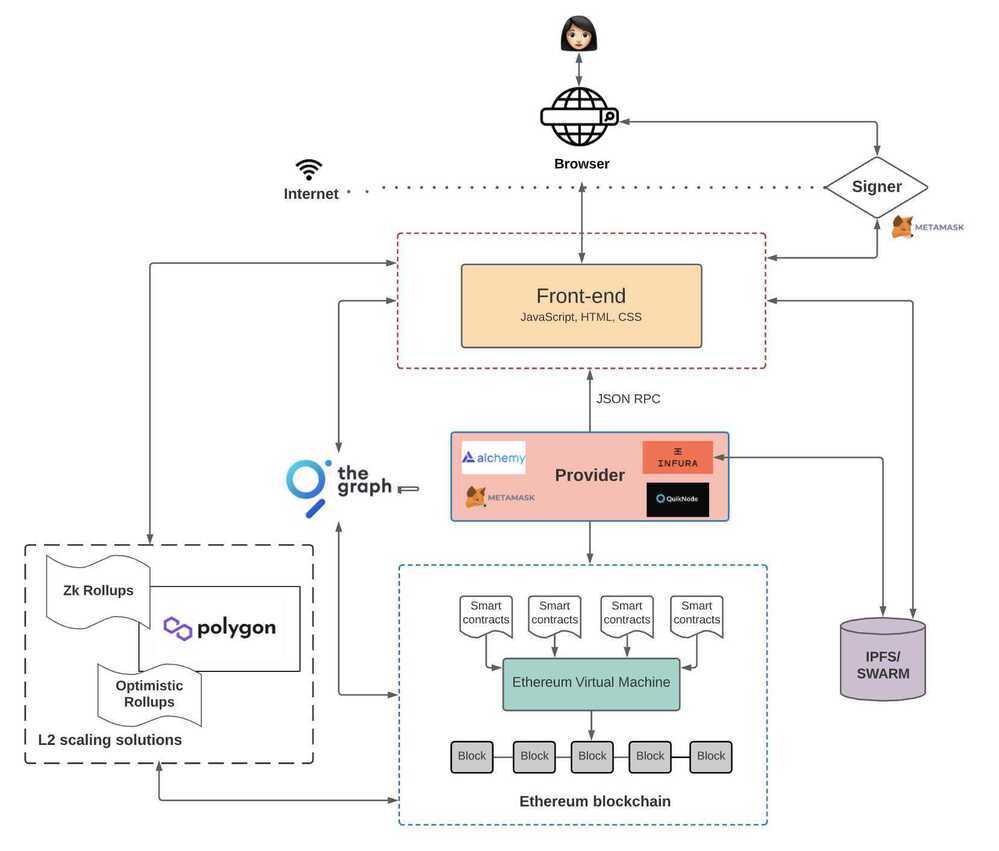

The Architecture of a Web 3.0 application

Trapdoor function

A trapdoor function is a function that is easy to compute in one direction but difficult to compute in the opposite direction unless you have special information. Trapdoor functions are essential for public key encryption - that's why they are commonly used in blockchain development to represent the ideas of addresses and private keys.

Chain Fork

Blocks in the ledger are included in such a way as to build the longest chain, i.e., the chain with the greatest cumulative difficulty. Forking is a situation where there are two candidate blocks competing to form the longest blockchain and two miners discover a solution to the proof-of-work problem within a short period of time from each other. The network is then divided, because some nodes get blocks from miner #1 and some from miner #2.

A fork usually gets resolved in one block, because the probability that this situation happens again gets extremely lower with the next blocks that arise, so soon there is a new longest chain that will be considered as main.

(Note: This type of fork is distinct from a hard fork, which is where some developers decide to create a backward-incompatible change to the blockchain protocol, resulting in two forever-distinct blockchains.)

Total Value Locked (TVL)

Тotal value locked represents the number of assets that are currently being staked in a specific protocol.

TVL is the net sum of all cryptocurrencies locked in a particular project.

Total value locked is a metric that is used to measure the overall health of a DeFi protocol.

Depending on the project, TVL can be indicative of the total amount of digital assets borrowed/lent, crypto staked, or the net amount of crypto residing in the liquidity pools of a decentralized exchange (DEX).

There are three main factors that are taken into consideration when calculating and looking at a decentralized financial services' market cap TVL ratio: calculating the supply, the maximum supply as well as the current price.

In order to get the current market cap, you need to multiply the circulating supply by the current price. In order to get to the TVL ratio, you would need to take that market cap number and divide it by the TVL of the service.

One of the main use of the TVL ratio is to help determine if a DeFi asset is undervalued or overvalued. If it is under 1, it is undervalued in most cases.

Total Value Locked (TVL) Definition | CoinMarketCap

TVL vs Market Cap vs TVL Ratio: Crypto Concepts - tastycrypto

- TVL (total value locked) refers to the total amount of cryptocurrency being employed by a DeFi project.

- Market cap refers to the total outstanding value of a project or blockchain cryptocurrency.

- TVL ratio gauges the health of a protocol.

Slippage

Slippage is the difference between the average purchase or sale price for a trade and the initial selling or market price. Slippage refers to the changes in the presiding price of an asset in the course of the execution of a trade request.

-

Slippage can be positive or negative depending on its impact on the final trade results. In a positive scenario, a buyer ends up realizing more tokens as the average purchase price becomes lower than the presiding selling price. The reverse is the case in a negative slippage scenario.

-

A major cause of slippage on centralized exchanges is the liquidity density and the spread across the order prices. Slippage on decentralized exchanges can be caused by other reasons, including tax contracts on the token’s smart contract.

-

Slippage on any trading platform can be controlled by modifying trading parameters or using slippage control facilities where they are available. Decentralized exchanges allow users to set up the maximum allowed slippage for their trades using the slippage modification feature.

What is Slippage in Crypto and How to Minimize Its Impact | CoinGecko

Others

recursive proofs for the rest of us! - Mohammad Jahanara - YouTube

Soft Fork vs Hard Fork in Crypto (ETH Classic, Litecoin, BTC Cash...) - YouTube